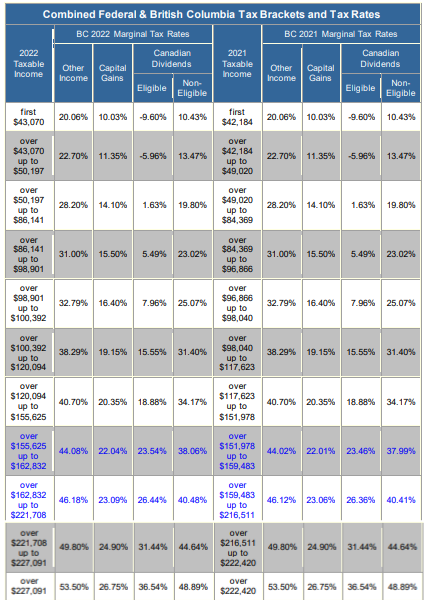

Personal Tax Rates

Effective January 1, 2022, the maximum insurable earnings will increase from $56,300 to $60,300. This means that an insured worker will pay EI premiums in 2022 on insured earnings up to $60,300.

In 2022, the employee EI premium rate will be $1.58 per $100. This premium rate and the MIE increase means that insured workers will pay a maximum annual EI premium in 2022 of $952.74 compared with $889.54 in 2021.

The maximum pensionable earnings under the Canada Pension Plan (CPP) for 2022 will be $64,900—up from $61,600 in 2021. The new ceiling was calculated according to a CPP legislated formula that takes into account the growth in average weekly wages and salaries in Canada.

Contributors who earn more than $64,900 in 2022 are not required or permitted to make additional contributions to the CPP.

The basic exemption amount for 2022 remains at $3,500.

The employee and employer contribution rates for 2022 will be 5.70%—up from 5.45% in 2021, and the self-employed contribution rate will be 11.40%—up from 10.90% in 2021. The increase in contribution rate is due to the continued implementation of the CPP enhancement